Introduction

The financial sector is evolving rapidly — from digital payments to AI-driven lending — and businesses in India are searching for the right banking and finance software company in Nagpur to stay competitive. With fintech expanding into automation, compliance, and real-time data, Nagpur has become an emerging hub for powerful BFSI technology solutions.

Whether you’re a business owner, a fintech startup founder, a tech professional, or a student exploring BFSI technology, this blog will simplify everything you need to know before choosing a finance software partner. For personalized guidance or BFSI software consulting, you can book a session here:

👉 https://appt.link/meet-with-chetan-chitriv-0E0czwAl/web-conference

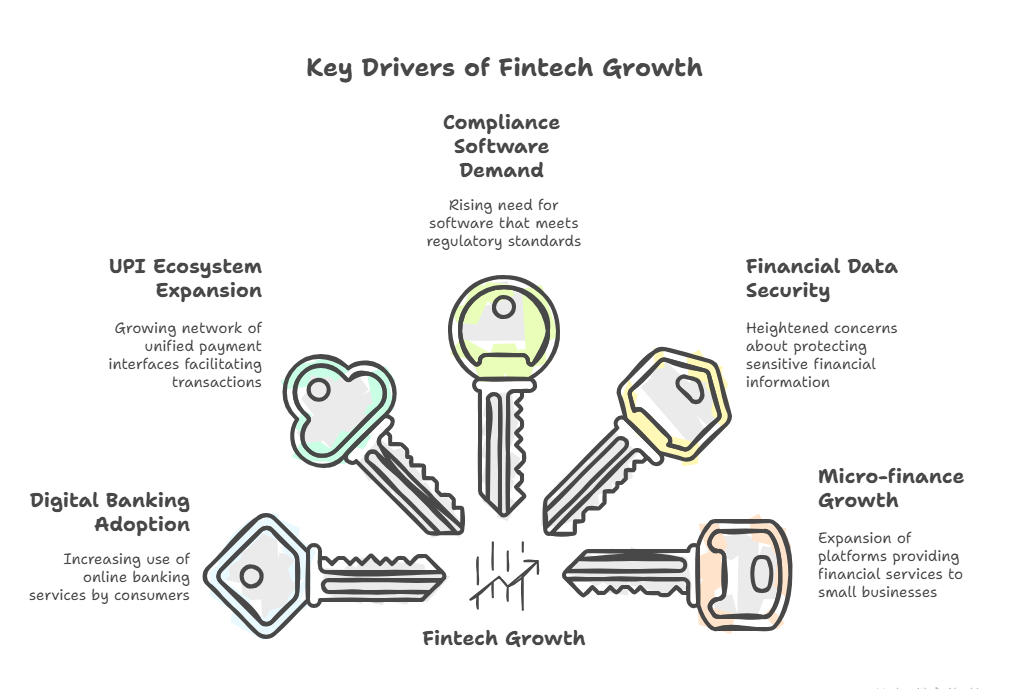

Fintech Growth in Nagpur

Nagpur has seen significant growth in fintech adoption, making it an excellent location for BFSI technology development. Increasing digital payments, banking automation, and financial compliance requirements have driven demand for a banking and finance software company in Nagpur.

Key growth drivers:

- Rising digital banking adoption

- Expanding UPI ecosystem

- Demand for compliance-ready software

- Increased financial data security concerns

- Growth of micro-finance and NBFC platforms

As BFSI needs become more complex, businesses in Nagpur are prioritizing scalable fintech solutions. This has positioned the city as a strong competitor in India’s digital finance landscape.

Core Solutions Offered by Banking & Finance Software Companies

A modern banking software development company in Nagpur provides a wide range of services tailored to fintech, NBFCs, and financial institutions. These platforms are built to enhance security, automation, and customer experience.

Common solutions include:

- Core banking systems (CBS)

- Loan management & digital lending platforms

- Payment gateway integrations

- AML/KYC automation tools

- Mobile banking applications

- NBFC & microfinance management software

- Investment & wealth-tech platforms

These solutions help businesses operate with greater efficiency and compliance. With digital finance expanding rapidly, companies in Nagpur are delivering enterprise-grade BFSI products with strong security and scalability.

Choosing the Right Partner in Nagpur

Selecting the right finance software solutions company in Nagpur requires careful evaluation. Not all BFSI software providers offer the same expertise, especially in areas like compliance, automation, and integrations.

What to look for:

- Experience with BFSI regulations (RBI, NBFC guidelines)

- Strong cybersecurity practices

- Scalable cloud architecture

- Expertise in mobile-first fintech apps

- Real-time analytics dashboards

- Secure API integrations

- Proven case studies

A good software partner should help you streamline operations, reduce manual workload, and offer long-term stability. The right company will align with your business model and future growth plans.

How to Prepare for Fintech Adoption

Businesses in Nagpur must prepare strategically before implementing modern BFSI solutions. This ensures a smooth transition and long-term success.

Step 1: Identify Operational Gaps

Evaluate areas like manual processes, compliance issues, slow reporting, or customer experience challenges. Understanding these gaps helps define your project roadmap.

Step 2: Choose the Right Technology Stack

Your banking or finance platform must support security, scalability, and integrations. Cloud, AI, and microservice architectures are becoming industry standards.

Step 3: Prioritize Security and Compliance

Encryption, RBAC, audit trails, and KYC/AML automation are essential. Look for a partner who understands RBI and finance compliance requirements.

Step 4: Plan Integrations with Existing Tools

Smooth connections with CRM, accounting systems, payment gateways, and analytics tools help improve overall operations.

Step 5: Focus on User Training & Adoption

Teams must understand the platform to use it effectively. Clear onboarding ensures a successful software rollout.

FAQ

1. Why choose a banking and finance software company in Nagpur?

Nagpur offers high-quality fintech development, competitive pricing, and strong BFSI domain expertise.

2. Do banking software companies in Nagpur offer mobile app development?

Yes, many provide secure mobile banking, digital lending, and finance management apps.

3. Are these companies experienced with NBFC or microfinance solutions?

Most leading fintech developers in Nagpur specialize in NBFC automation, lending systems, and compliance tools.

Conclusion

Nagpur is rapidly becoming a strong destination for fintech innovation, offering reliable and scalable solutions for banks, NBFCs, and financial institutions. Choosing the right banking and finance software company in Nagpur can help you improve compliance, enhance customer experience, and digitize operations with confidence.

For expert consultation or custom BFSI software development, book a session here:

👉 https://appt.link/meet-with-chetan-chitriv-0E0czwAl/web-conference

Recommended Websites:

- https://avestantechnologies.com/

- https://www.talentrisetechnokrate.com/

- https://technokrate.com/

- https://www.softwavetechify.com/

- https://chetanchitriv.in/

Here, check this out —

Creating an Enterprise-Level Data Analytics Dashboard

https://medium.com/@marketingtalentrisetechnokrate/creating-an-enterprise-level-data-analytics-dashboard-e239de9f3aaf